Although the precept of ribā prevents Muslims from taking out typical house loans, as a result of it would be wrong to pay interest, a loan like this doesn't require you to do so. Under risk of imprisonment, he was also ordered to disclose any financial institution accounts under his control, individuals he is indebted to and the amount owed, and a listing of his property and liabilities. Investment advisory firm Hejaz Financial Services is in search of a banking licence from the prudential regulator because it builds a vertically built-in one-stop wealth shop for the growing but under-banked Muslim group. Use our help guides, FAQs and other assist companies that will help you manage your banking extra simply. If you’re accredited and settle for our loan supply by way of NAB Internet Banking, your money will be ready in a single business day. No penalties if you make early repayments or exit charges if you repay your loan sooner.

Acknowledgement of CountryWe acknowledge the Aboriginal and Torres Strait Islander peoples as the primary Australians and Traditional Custodians of the lands the place we live, work and financial institution. Hypotheticals, illustrations and examples on the internet site are offered for illustrative purposes only. They shouldn't be relied on by individuals once they make investment decisions. Unfortunately, we can ONLY finance for self-employed clients who've an ABN which is buying and selling. We are endeavoring to have a shopper finance product in January 2025 to satisfy this extra demand Insha’Allah. We are unable to finance vehicles for Uber or Ride Share automobiles, laser hair removal machines (except for Medical Doctors or specialist Skin Clinics), and fitness center tools.

(First Home Owners Grant Scheme) This application should be supplied to MCCA no later than three weeks previous to the matter settling. If you liked this article and you simply would like to acquire more info concerning

sharia compliant car finance nicely visit our page. The software needs to have all new up to date documentation and be resubmitted to the assorted entities when you have discovered the mentioned property. The client name might be registered on the title, on the Shariah understanding that through the settlement period that the shopper might be holding the property as agent of MCCA. Yes, an Independent authorized advisor registered to follow in that abroad location can witness the signing of the mortgage documents.

This profit is clear and glued, distinguishing it from interest-based conventional loans. Islamic Car Finance presents quite a few advantages to Australian residents and buyers looking for ethical and Sharia-compliant financial options for buying vehicles. As a supplier of halal car finance in Australia, Islamic Car Finance adheres to Islamic finance ideas, ensuring that each one transactions are ethically sound and compliant with Sharia regulation. Asset-backed Islamic car finance and business asset finance are pivotal tools inside Islamic finance, facilitating the acquisition of automobiles and business belongings through Shariah-compliant financing structures. In Islamic asset-backed financing, varied modes corresponding to musharakah, mudarabah, and ijarah are generally utilized to guarantee compliance with Islamic law.

Additionally, secondary documentation could also be required, together with utility bills or financial institution statements, to corroborate the applicant’s residential handle and additional substantiate their identity. This layered strategy to verification is crucial to maintaining the integrity and trust inherent in sharia compliant monetary transactions. Once you have chosen a provider, the subsequent step is making use of in your Murabahah car finance. The course of typically includes expressing your intent to buy a car using Murabahah financing, agreeing on the terms, purchasing and promoting of the car by the supplier, and finally, repaying the loan over the agreed period.

Islamic Finance & Investments Affiliation

For Muslims in Australia, Islamic car financing serves as an important alternative to standard loans, adhering to ideas that keep away from interest (riba) and guarantee ethical monetary dealings. The credit score historical past evaluate, therefore, examines an applicant’s financial historical past, together with past loans, compensation conduct, and current liabilities. This complete assessment helps lenders determine whether a person can responsibly manage an Islamic loan without compromising their monetary stability. Frequently, an intensive credit history verify is carried out to assess the monetary duty and reliability of these in search of Islamic car financing. This practice is essential to making sure that applicants meet the stringent eligibility standards set forth by financial institutions in Australia offering sharia-compliant car finance solutions. To qualify for Islamic car financing in Australia, applicants must adhere to particular criteria grounded in Sharia rules.

Acknowledgement of CountryWe acknowledge the Aboriginal and Torres Strait Islander peoples as the first Australians and Traditional Custodians of the lands the place we stay, work and bank. If you wish to improve your financed quantity, then you will need to amend your utility to be reassessed again. Yes, permitted applicants might want to nominate an Australian bank account held in their name(s) from which the agreed finance instalments shall be debited. ICFAL offered some adjustments to how Ijaarah finance contracts work in Australia. ICFAL proposed to make the Ijaarah residence finance model extra like rental laws than credit score legal guidelines. Invest your hard-earned cash the halal approach to personal the house and name it residence.

Buying the car in installment utilizing a halal contract permits you to personal a car at ease. Learn extra about how our halal products finances you to a better dwelling. Car finance with ICFAL permits you to acquire brand new or a used in your day by day utilization. These choices are complimented with aggressive features that let you get a car by Halal means.

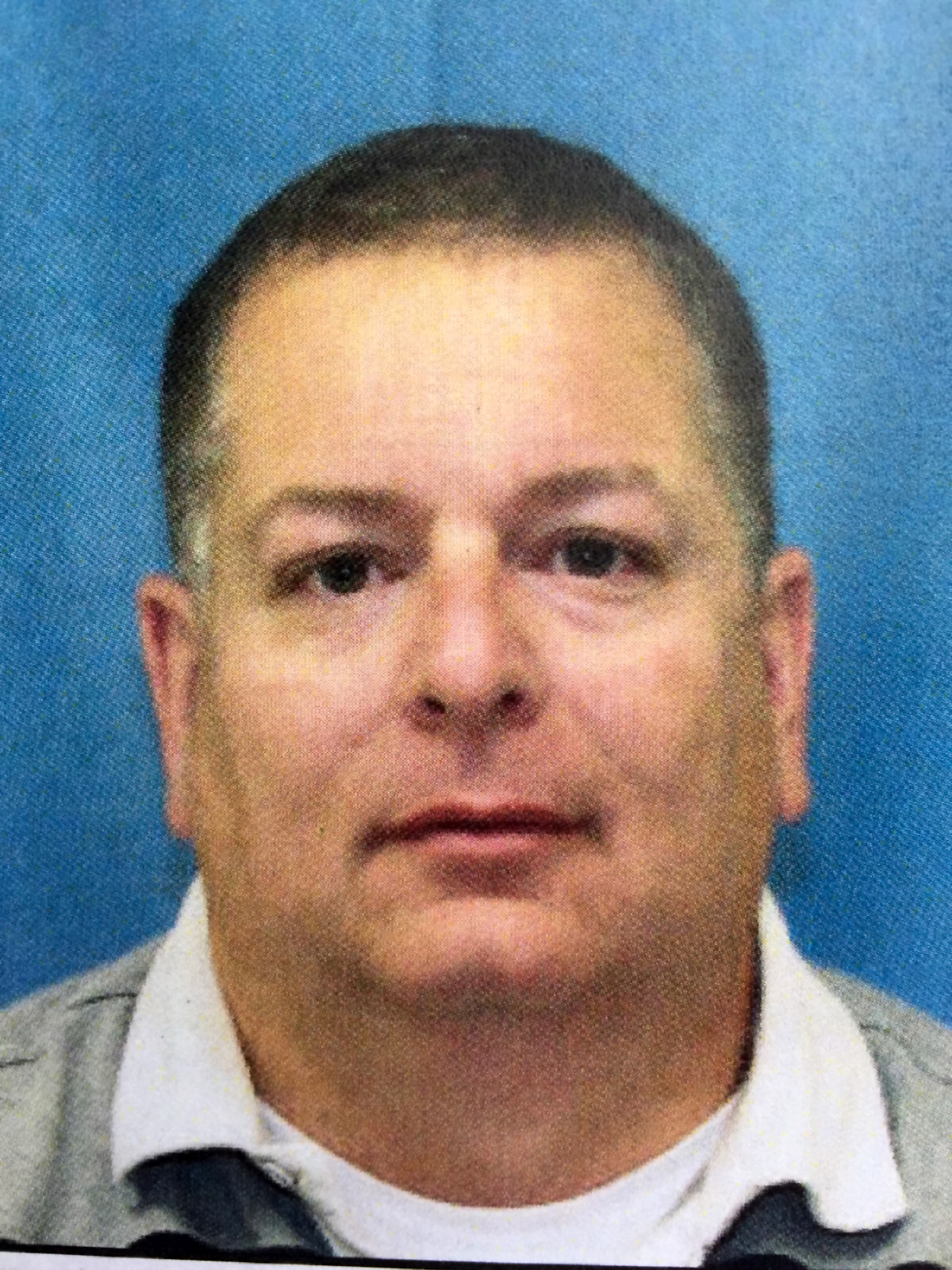

EFSOL marketed itself as Australia's largest, worldwide Islamic finance firm and partly targeted the country's Somali neighborhood, according to a previous Daily Telegraph report. ASIC suspects those funds "ought to have remained with EFSOL for the needs of paying liabilities, or potential liabilities, owed to EFSOL shoppers". An affidavit tendered in the proceedings discloses the probe revolves round suspected breaches of company law and suspicion of dishonestly obtaining property or financial benefit. The Comparison Rate is based on a loan amount of $30,000 and is calculated over a term of 5 years based on month-to-month repayments. Before you apply, see what you'll have the ability to afford to borrow and what your car loan repayments can be with our useful calculators.

That’s one reason why ASIC insists Sharia-compliant financiers show their costs like an interest rate. Just like with comparability charges for interest-based mortgages that permit borrowers to shortly and simply compare the equivalent complete price of all presents on the market, regardless of how a lot each particular person element costs. Some homebuyers mistakenly assume Islamic residence loans in Australia simply make a superficial effort to adjust to Islamic regulation, but that couldn’t be further from the truth. Often, that’s as a result of they see Sharia-compliant merchandise displayed with an rate of interest.

This is a big misnomer because utilizing a proportion is only a methodology of pricing.