Islamic car finance provides a Sharia-compliant, moral resolution for acquiring automobiles. Based on ideas of transparency and fairness, it avoids riba (interest) and promotes risk-sharing. Murabaha entails the financier buying the car and promoting it to the client at a profit, while Ijarah is a leasing arrangement the place possession transfers after lease completion.

We acknowledge the Aboriginal and Torres Strait Islander peoples as the first Australians and Traditional Custodians of the lands where we live, work and operate our enterprise. Rates and product data must be confirmed with the related credit supplier. For extra info, read InfoChoice.com.au’s Financial Services and Credit Guide (FSCG). According to the Australian Federation of Islamic Councils, as of 2021, different suppliers of Islamic home financing include Ijarah Finance, MCCA, Hejaz, Amanah Finance, and ICFAL.

We are committed to helping you to buy a automobile at an inexpensive worth by using an Islamic mode of financing Murabahah Principle. Thirdly, seller and buyer ought to agree on the sale and revenue margin. Lastly, the settlement must outline cost terms, including the variety of installments and due dates. By selecting Halal Mortgage Australia, you're partnering with an organization that prioritizes compliance with the very best requirements of Islamic finance.

When determining whether car finance is permissible beneath Islamic regulation, it is important to take into account the ideas of Sharia that govern monetary transactions. Islamic finance prohibits riba (interest), which is considered exploitative and unjust. As a end result, any car finance resolution should be interest-free to be halal. The idea of Sharia-compliant car finance has been developed to align with these rules, ensuring that Muslims can finance a model new or used car islamically. Applying for Halal car finance entails several key steps to make sure compliance with Islamic principles.

Prospective candidates for halal vehicle financing in Australia must meet specific primary eligibility necessities to qualify for these sharia-compliant monetary merchandise. Islamic car finance, rooted in Islamic rules, mandates that applicants adhere to each basic financial criteria and extra sharia-specific guidelines. Financing a model new car with Islamic rules includes careful planning, analysis, and adherence to Shariah regulation. By understanding the totally different financing options, consulting with experts, and selecting a good financial establishment, you'll find a way to efficiently finance your new car in a manner that aligns together with your non secular beliefs. Embrace ethical financial practices and make informed selections to make sure a smooth and Shariah-compliant car financing expertise. Our Ijarah strategy aligns with the Islamic principle of a trade-based association which entails an asset being purchased by the financier and then the client pays Rent to use the Asset.

Islamic Car Finance

Paying for a valuation report or for finance processing payment doesn't imply an automated approval. Anyone, Muslim or non-Muslim can apply for finance, however approval of funds is topic to meeting the relevant evaluation standards in pressure on the time of application. If you are over the age of 30 and looking for an ethical, financially secure answer on your next car buy, then the world of Halal car finance in Australia could be just the ticket for you. In explicit, you may find a financing methodology known as Murabahah, a standard practice in Islamic finance, to be your best solution. Insaaf has the best car finance options to provide the finest offers on your new set of wheels.

The software course of for a halal car loan typically involves offering proof of revenue, identification documents, and details concerning the car being financed. Once the appliance is submitted, the finance company critiques the data to assess the applicant's monetary stability and adherence to Islamic principles. Islamic Car Finance offers quite a few advantages to Australian residents and traders in search of ethical and Sharia-compliant financial solutions for purchasing vehicles. As a supplier of halal car finance in Australia, Islamic Car Finance adheres to Islamic finance principles, guaranteeing that all transactions are ethically sound and compliant with Sharia regulation. The legal guidelines of Islam govern every facet of a Muslim’s life, together with their monetary activities. Islamic legal guidelines don't enable for Muslims to borrow on interest and as a result, Muslims are restricted out there as a result of prohibition of typical banking merchandise.

In distinction, standard car loans contain borrowing cash from a financial institution and repaying it with interest over time. This interest is considered riba, making such loans non-compliant with sharia rules. Islamic car finance choices make sure that transactions are ethical and in alignment with Islamic values. Islamic car finance fits throughout the broader scope of asset finance, specializing in the tangible worth of the automobile quite than speculative positive aspects.

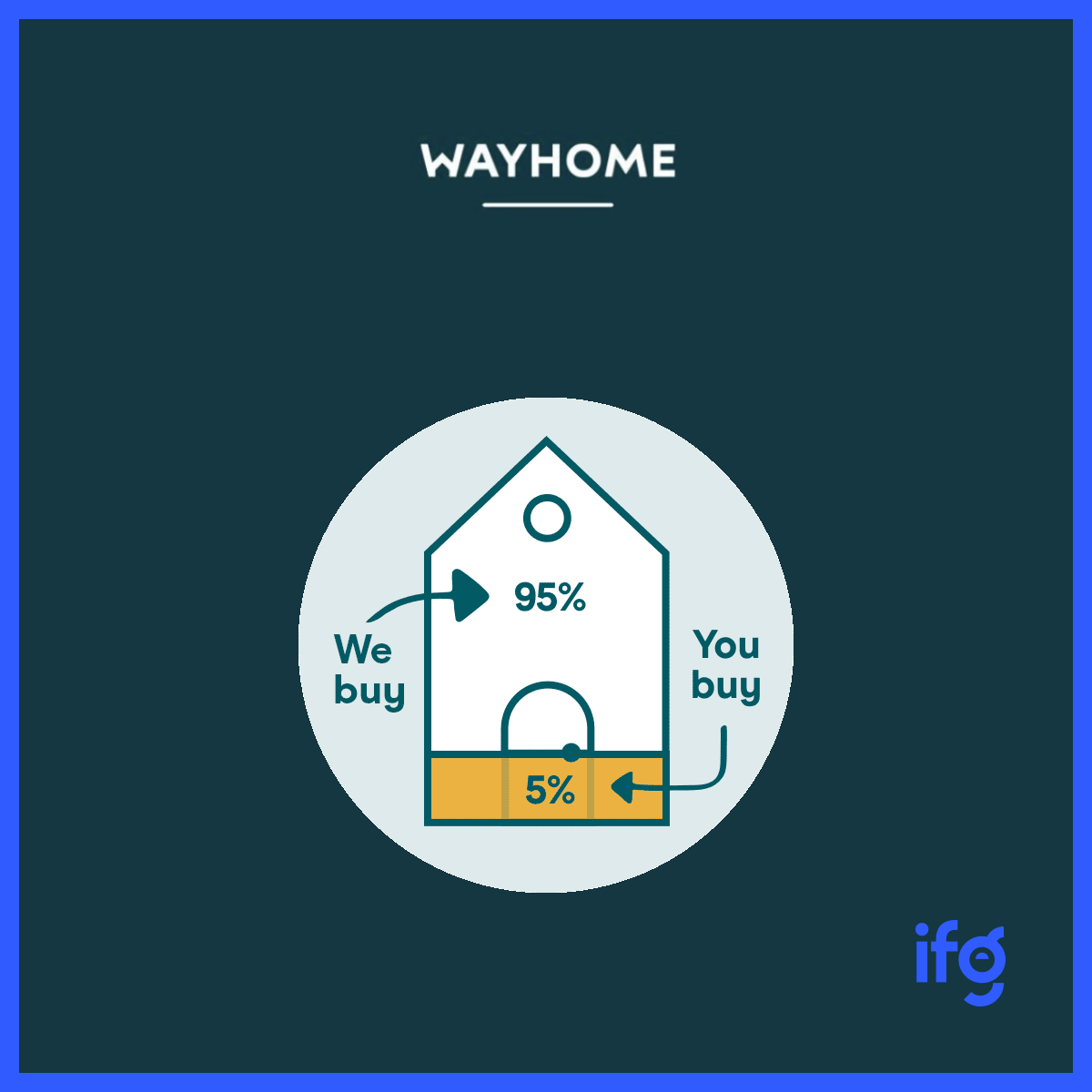

For mortgage brokers servicing Muslim purchasers in search of Sharia-compliant choices, Shaik stated it’s essential to grasp the nuances of merchandise like rent-to-own arrangements. Also often identified as Islamic finance, Sharia-compliant finance is a monetary system that operates in accordance with Islamic regulation, or Sharia. "There’s a notable shift amongst groups, such as well-informed skilled migrants eager to get into the market and people moving from conventional to Sharia-compliant choices as Islamic charges become extra aggressive," Shaik stated. Initial approval process which offers an estimate of how much a potential consumer may receive (before identifying the property to be purchased for the client to possess/occupy), primarily based on the data supplied to MCCA. As such, MCCA is not entitled to share the revenue arising from the sale of the property during the Ijarah term and similarly not required to share the loss. Our residence finance merchandise are primarily based on a Shariah understanding of lease arrangement that ends in possession additionally recognized in the Islamic Finance trade as Ijarah Muntahia Bittamleek.

By adhering to these rigorous proof of identity requirements, applicants can confidently proceed with their halal car finance purposes, contributing to a transparent and trustworthy financial ecosystem. Prospective candidates for halal car financing in Australia must meet specific basic eligibility requirements to qualify for these sharia-compliant monetary products. Islamic car finance, rooted in Islamic ideas, mandates that candidates adhere to each general monetary standards and extra sharia-specific pointers. In the context of car finance, Islamic finance makes use of strategies such as Murabaha (cost-plus financing) or Ijarah (leasing). In a Murabaha transaction, the monetary establishment purchases the automobile and sells it to the shopper at a profit margin agreed upon upfront, guaranteeing that the transaction stays interest-free.

Islamic Home Loans Learn And Examine

Both Akram and Furkat have been approachable, knowledgeable, and patient, guiding me each step of the greatest way. If you enjoyed this short article and you would certainly such as to get even more info pertaining to

click through the up coming article kindly check out our web site. I extremely advocate Ayan Capital to anybody looking for moral, halal finance solutions.