That makes sense given their 5.7%-greater gold output with 21.4%-larger average gold prices. Yet this massive upleg still has a protracted ways to run yet given the most important gold miners’ colossal earnings development and resulting super-low valuations even this week. As discussed final week in my essay on large US stocks’ Q1’20 results, the top 5 tech stocks dominating US markets noticed 14.0% gross sales development. Kinross Gold provided an amazing instance in its Q1 outcomes, "On March 20, 2020, Kinross drew down $750 million from its $1.5 billion revolving credit score facility as a precautionary measure to protect towards financial and business uncertainties associated to the pandemic." That appears prudent. Offshore production platforms could also be marvels of modern engineering, however none of that priceless petroleum makes its approach out of the wells and into refineries without quite a lot of human labor. Our newsletters are a great way, simple to learn and reasonably priced. What Are The Products Offered By Allegiance Gold?

That makes sense given their 5.7%-greater gold output with 21.4%-larger average gold prices. Yet this massive upleg still has a protracted ways to run yet given the most important gold miners’ colossal earnings development and resulting super-low valuations even this week. As discussed final week in my essay on large US stocks’ Q1’20 results, the top 5 tech stocks dominating US markets noticed 14.0% gross sales development. Kinross Gold provided an amazing instance in its Q1 outcomes, "On March 20, 2020, Kinross drew down $750 million from its $1.5 billion revolving credit score facility as a precautionary measure to protect towards financial and business uncertainties associated to the pandemic." That appears prudent. Offshore production platforms could also be marvels of modern engineering, however none of that priceless petroleum makes its approach out of the wells and into refineries without quite a lot of human labor. Our newsletters are a great way, simple to learn and reasonably priced. What Are The Products Offered By Allegiance Gold?

Allegiance Gold has garnered positive industry rankings and opinions, solidifying its status as a dependable funding option. The very fact that folks have developed a preference for funding gold is just one reason. ICICI Prudential Gold ETF is top-of-the-line Gold ETFs, it is an open-ended commodity scheme that is good for long term investment. With gold still powering increased on mounting investment demand, the resulting higher prevailing gold prices this quarter should make for stable Q2 outcomes despite this crazy pandemic. The gold miners are being profitable hand over fist on this larger-gold-price setting, regardless of their increased prices for mitigating COVID-19 risks. From the volatility of market prices to the potential for fraud or scams, it is necessary to totally understand the risks earlier than making any funding decisions. APMEX also has a mobile app that makes it simple to stay up-to-date on market traits and manage your funding portfolio. However, at the end of the day, the stock market nonetheless carries plenty of threat. See the non-public providing memorandum for every CPM hedge fund for complete information and danger components. Gold is mostly thought-about a hedge against inflation and permits traders to diversify their portfolios.

Muruntau is the fifth deepest open-pit mine on this planet, and hosts one in all the only largest deposits of gold. We've got already researched over one hundred gold funding companies and located one company to stand out above the remainder. And they'll possible get much larger in coming months as this gold-stock upleg keeps powering higher on large gold investment. The fuel cell will compete with many different energy conversion devices, together with the fuel turbine in your city's energy plant, the gasoline engine in your automobile and the battery in your laptop computer. Silver is a precious steel that's used for varied purposes, together with jewellery, price electronics, and solar panels. During that period of unexplainable fall in gold prices, there was barely any recognizable buying and selling momentum compared to different durations, which exhibits that traders had both pulled out their investments in the yellow steel or principally chose to carry on to their positions and keep away from trading. And these low-cost valuations are set to fall even farther as gold-mining earnings proceed growing. While gold-mine shutdowns have lasted longer in Q2, loads of main gold miners stay unaffected on account of the place their mines are located. Surging cash hoards give the gold miners far more flexibility in adjusting to the more-costly reality of mitigating COVID-19, giving them extra survivability as heavy-handed governments quickly shutter their mines.

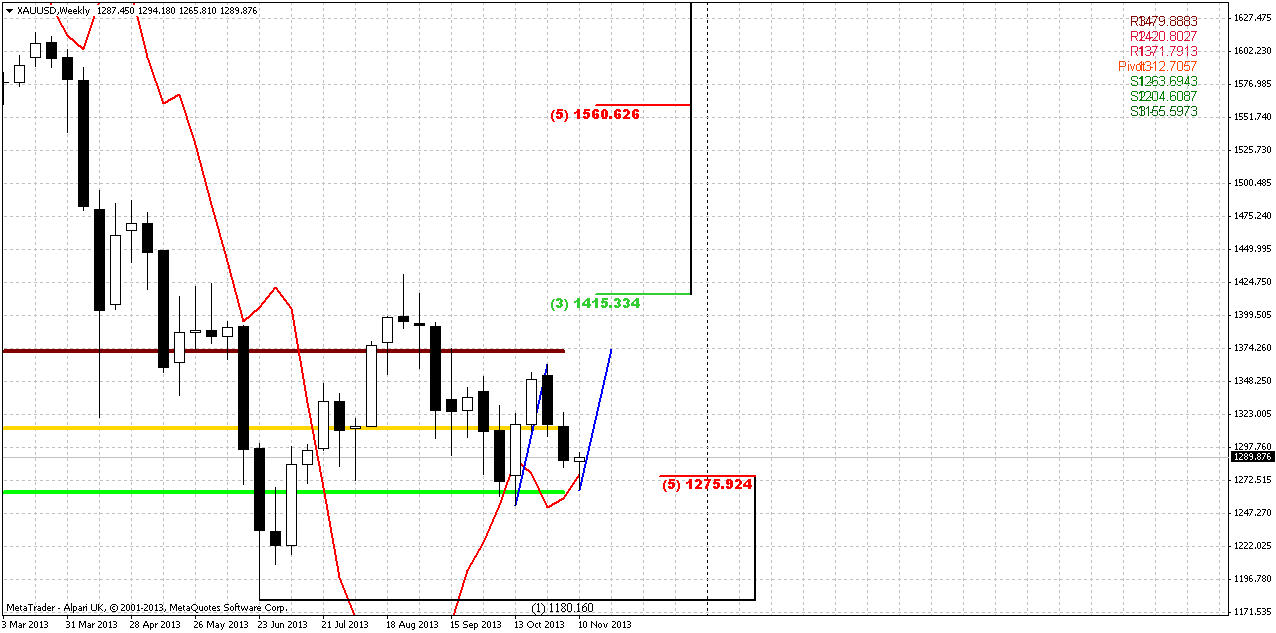

Even adjusting for these big unusual objects, the GDX high 34’s total income nonetheless soared 73.9% YoY last quarter! The GDX top 34’s whole gross sales soared 31.1% YoY to $12.1b! Operating money flows generated by the GDX high 34’s gold mining rocketed 68.7% higher YoY to $4.7b! In Q1’20, the key gold miners’ whole accounting earnings soared an epic 163.6% YoY to $1.9b! The key gold miners’ inventory prices are likely to amplify materials gold moves by 2x to 3x because of their comparable profits leverage to larger gold prices. Trolling, "flaming" and "spamming" (the repetitive posting of the identical material) together with posting patterns that recommend your intent is to "drown out" other speech is expressly prohibited. It does that by leaving patterns on the price charts. Predicting the future of gold prices isn't straightforward, however to supply some insights into what 2024 would possibly hold, we have compiled an array of gold price forecasts, outlooks, and predictions from famend banks, industry consultants, and monetary analysts. Technically so long as price remains above $1122 both of the triangle choices remain valid, solely a break of $1122 (Dec 2016 low) would suggest we consider Idea 1 and look for low around $1100 - 1120 to setup for a rally back above $1375 (Jul 2016 excessive).

Even adjusting for these big unusual objects, the GDX high 34’s total income nonetheless soared 73.9% YoY last quarter! The GDX top 34’s whole gross sales soared 31.1% YoY to $12.1b! Operating money flows generated by the GDX high 34’s gold mining rocketed 68.7% higher YoY to $4.7b! In Q1’20, the key gold miners’ whole accounting earnings soared an epic 163.6% YoY to $1.9b! The key gold miners’ inventory prices are likely to amplify materials gold moves by 2x to 3x because of their comparable profits leverage to larger gold prices. Trolling, "flaming" and "spamming" (the repetitive posting of the identical material) together with posting patterns that recommend your intent is to "drown out" other speech is expressly prohibited. It does that by leaving patterns on the price charts. Predicting the future of gold prices isn't straightforward, however to supply some insights into what 2024 would possibly hold, we have compiled an array of gold price forecasts, outlooks, and predictions from famend banks, industry consultants, and monetary analysts. Technically so long as price remains above $1122 both of the triangle choices remain valid, solely a break of $1122 (Dec 2016 low) would suggest we consider Idea 1 and look for low around $1100 - 1120 to setup for a rally back above $1375 (Jul 2016 excessive).