Are you a novice on earth of cryptocurrency trading? Possess you been pestered along with insight and also methods that guarantee to create you a fortune overnight? It is actually time to different reality from myth and also bust a few of the very most common fallacies neighboring crypto trading. In this short article, our team will certainly plunge into the world of day exchanging, checking out the approaches that in fact work and also disproving the ones that are nothing much more than a waste of time.

Coming from specifying practical requirements to recognizing market fads, our company'll equip you with the expertise you need to do well in the impressive planet of cryptocurrency trading. Thus order your coffee, settle in, and also prepare yourself to expose those crypto trading myths finally.

Disproving the Myth: Easy Crypto Day Trading Strategies for Beginners

Tabulation

What is crypto day trading?

Relevance of establishing targets.

Knowing market fads.

Risk control techniques.

Selecting the ideal investing platform.

Technical study essentials.

Key evaluation basics.

Establishing up an exchanging plan.

Dealing with emotions while investing.

Usefulness of continual learning.

Tips for lessening losses.

Creating a self-displined exchanging routine.

Empower Your Crypto Trading Journey along with

signal Crypto For All: The Ultimate Day Trading Platform for Beginners

1. What is actually crypto time investing?

To succeed in crypto day investing, novices should check market patterns, study price graphes, and also bring in easy choices based on technological and also key study. Establishing crystal clear goals, handling dangers effectively, and deciding on an appropriate investing system are crucial. An investing strategy along with access and also leave aspects, as effectively as stop-loss orders, can easily assist in bring in informed decisions and decreasing losses. Emotional states are vital in trading, so it's critical to continue to be disciplined and stay clear of spontaneous decisions steered by fear or even greed.

What is crypto time trading?

Continual learning is essential to

remaining lucrative, therefore staying improved on information and developments is critical. Cultivating a regimen that consists of routine review, assessing previous fields, and also adjusting techniques as needed to have will definitely bring about results in crypto day trading.

2. Value of setting goals.

Preparing crystal clear, manageable targets are going to assist your trading approach and help you remain concentrated amidst the market place's improvements. Recognizing market patterns is essential for helping make educated choices. Newbie investors ought to likewise focus on risk management methods to shield their funding. Choosing the correct trading platform that aligns along with your objectives and also tastes is an essential selection that may impact your exchanging success.

Usefulness of preparing goals.

Novices should likewise discover fundamental technical analysis to translate rate graphes and acknowledge entry and also exit factors. Essential study is crucial also, as it exposes the factors determining cryptocurrency costs. Producing a detailed exchanging plan describing your goals, risk tolerance, best crypto trading signals and also methods is a critical intervene being successful at crypto time investing. Emotions may cloud judgment, therefore handling them effectively as well as staying with your planning is vital. Ongoing learning and also remaining updated concerning market developments will definitely boost your investing skill-sets as you get through the globe of crypto time investing.

3. Recognizing market trends.

Newbies should learn to identify trends like uptrends, declines, and also sidewards fads to create better trading decisions. Conducting technical analysis and researching historical price records may offer knowledge into market patterns. Keeping improved on present market patterns through information sources, market evaluation reports, as well as social networks networks can easily boost exchanging tactics. Monitoring elements like regulatory growths, economical red flags, and also industry headlines may aid amateurs foresee rate motions. Being practical and conforming promptly to changing health conditions may strengthen amateurs' chances of success in crypto time trading.

Knowing market styles.

4. Risk administration approaches.

Very carefully managing leverage by spreading assets around several cryptocurrencies helps relieve threat. Regularly examine risk-reward ratios for each and crypto signal every profession and also adjust tactics accordingly. Focus on danger control to successfully trade, centering on protecting funding. Education and learning and technique are essential to comprehending threat and developing successful danger administration strategies tailored to individual trading types.

Danger control strategies.

Prosperous investors recognize the importance of decreasing losses and also making best use of earnings in the crypto market.

5. Selecting the correct trading platform.

Various trading systems have special tools as well as components for various trading types. Beginners should take into consideration fees, assisted cryptocurrencies, customer help, and also consumer expertise when choosing a system. It is actually essential to guarantee the system complies with guidelines and safeguards real estate investors' funds. Also, newbies must learn more about the platform's components to strengthen trading productivity.

Picking the ideal exchanging system.

Knowing how to trade, established stop-loss purchases, track performance, and also get access to market information can impact effectiveness. Lots of systems provide demonstration make up method. By utilizing platform tools successfully, amateurs may create enlightened decisions in the inconsistent crypto market.

6. Technical study rudiments.

Technical review resources feature pattern lines,

Signal Crypto assistance as well as protection levels, as well as signs like relocating standards and also Relative Strength Index (RSI). Through examining previous cost movements, traders can recognize patterns and fads to forecast potential rate improvements. Beginners in crypto day exchanging need to grasp the basics of specialized evaluation. Checking out price graphes and interpreting red flags can easily deliver understandings right into market health conditions as well as achievable entrance or leave factors.

Technical review essentials.

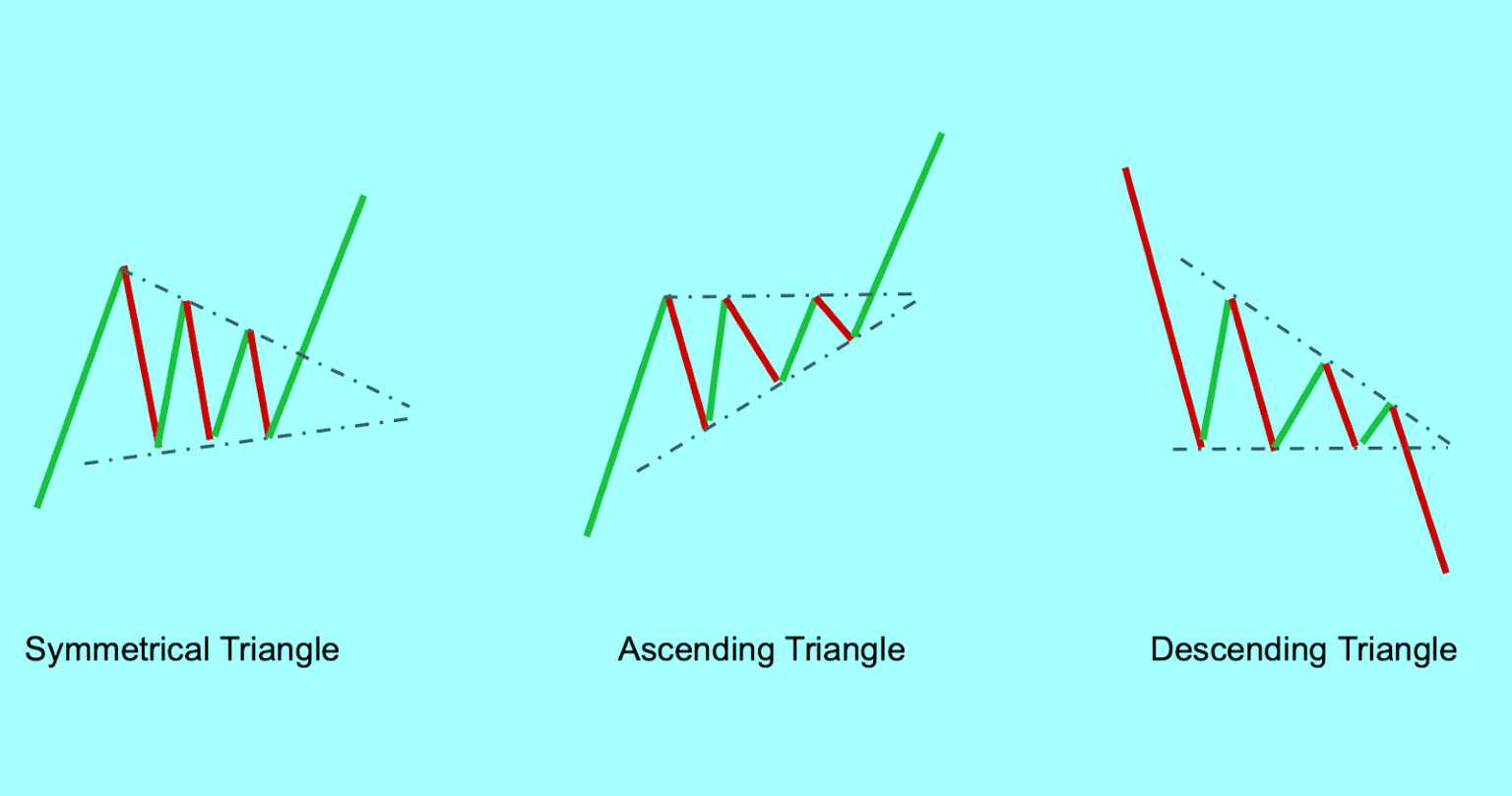

Identifying graph patterns like triangulars and head and also shoulders can easily aid investors identify opportunities. In a similar way, knowing momentum signs like the Moving Average Convergence Divergence (MACD) can easily aid traders examine rate action durability. Efficiency in technological analysis can easily boost a trader's decision-making and boost their total exchanging strategy.

7. Vital review essentials.

Beginners in crypto day exchanging must understand the basics of a coin or token to bring in knowledgeable trading selections. By assessing whitepapers, roadmaps, and also relationships, investors can easily acquire understandings right into a task's possible growth and lasting stability. Staying on par with news updates and business fads is likewise significant to remain notified regarding factors affecting the cost action of a cryptocurrency.

Basic study fundamentals.

Economic indicators, market conviction, guidelines, as well as worldwide occasions can easily affect the cryptocurrency market. Novices need to use key analysis alongside technical analysis to have an extensive review of the market. Through combining both strategies, traders can make well-informed decisions based upon an in depth understanding of a cryptocurrency's fundamentals as well as market environment.