Are you an amateur on the planet of cryptocurrency investing? Possess you been actually bombarded along with suggestions as well as approaches that guarantee to create you a fortune through the night? It is actually time to separate simple fact coming from myth as well as demystify a number of the best popular fallacies bordering crypto exchanging. In this short article, our team will certainly dive right into the world of time investing, checking out the techniques that actually function as well as debunking the ones that are actually absolutely nothing much more than a refuse of time.

Coming from establishing realistic desires to understanding market trends, we'll equip you along with the understanding you need to succeed in the fantastic world of cryptocurrency trading. So grab your coffee, work out in, as well as prepare to debunk those crypto investing fallacies at last.

Exposing the Myth: Easy Crypto Day Trading Strategies for Beginners

Tabulation

What is crypto day investing?

Relevance of specifying objectives.

Comprehending market fads.

Threat monitoring approaches.

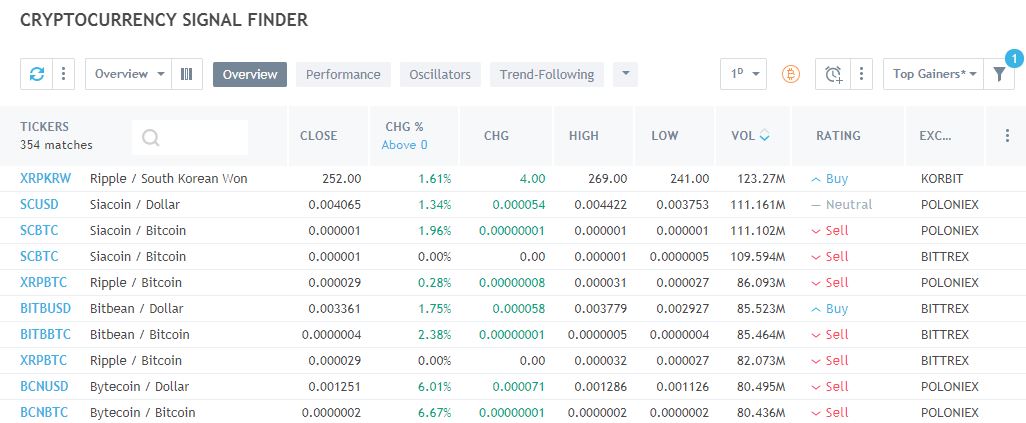

Choosing the ideal investing system.

Technical study fundamentals.

Key evaluation fundamentals.

Putting together a trading plan.

Taking care of emotional states while investing.

Usefulness of constant learning.

Tips for lessening losses.

Establishing a self-displined investing program.

Empower Your Crypto Trading Journey along with Signal For All: The Ultimate Day Trading Platform for Beginners

1. What is actually crypto time investing?

To succeed in crypto day investing, newbies need to keep an eye on market fads, examine cost graphes, and bring in fast choices based on specialized and key review. Preparing crystal clear objectives, managing dangers properly, as well as picking an appropriate trading platform are key. An exchanging planning with entry as well as exit aspects, and also stop-loss orders, can help in bring in educated choices as well as reducing reductions. Emotional states are vital in exchanging, so it's crucial to stay disciplined and also stay away from spontaneous decisions steered through fear or even greed.

What is actually crypto time exchanging?

Continual knowing is actually crucial to staying financially rewarding, thus staying upgraded on information and also developments is critical. Building a schedule that features frequent review, evaluating past trades, as well as adjusting methods as needed will bring about effectiveness in crypto time exchanging.

2. Significance of preparing objectives.

Specifying very clear, manageable goals will certainly assist your trading tactic and help you remain centered amidst the market place's modifications. Understanding market trends is critical for helping make notified choices. Amateur investors must additionally focus on danger monitoring strategies to safeguard their funding. Selecting the appropriate trading system that aligns with your goals as well as inclinations is a crucial decision that can impact your trading results.

Usefulness of specifying objectives.

Amateurs need to additionally learn basic specialized study to translate price graphes and acknowledge access and also leave aspects. Essential analysis is necessary also, as it exposes the factors determining cryptocurrency prices. Developing a thorough exchanging strategy summarizing your objectives, threat resistance, and also tactics is an essential measure in succeeding at

crypto signals telegram time trading. Feelings can easily overshadow opinion, therefore handling them properly and also following your planning is actually important. Ongoing understanding and keeping educated regarding market advancements are going to enhance your trading abilities as you get through the planet of crypto time investing.

3. Knowing market styles.

Beginners need to know to determine fads like uptrends, drops, and sideways trends to make better trading selections. Administering specialized analysis as well as studying historical rate data can supply insights into market fads. Remaining updated on present market styles by means of news resources, market analysis documents, as well as social media sites channels may improve trading strategies. Tracking variables like regulative growths, economical clues, as well as sector information can help beginners foresee price actions. Being actually aggressive and signal crypto adapting fast to modifying problems may boost amateurs' odds of results in crypto time investing.

Comprehending market trends.

4. Danger control methods.

Meticulously dealing with utilize by spreading out investments throughout various cryptocurrencies helps mitigate risk. Constantly determine risk-reward proportions for each profession and cryptocurrency signals also readjust strategies correctly. Focus on risk management to successfully trade, paying attention to keeping capital. Education and learning as well as technique are actually vital to comprehending threat and establishing reliable risk control methods tailored to individual investing types.

Risk administration strategies.

Productive investors acknowledge the significance of minimizing losses and also optimizing profits in the crypto market.

5. Picking the best investing system.

Various exchanging platforms have special tools and also functions for various trading styles. Beginners should think about fees, assisted cryptocurrencies, customer support, and individual adventure when choosing a system. It is actually important to guarantee the system complies with laws and defends capitalists' funds. In addition, novices need to find out about the system's attributes to enhance trading performance.

Deciding on the appropriate investing system.

Knowing just how to trade, prepared stop-loss purchases, monitor functionality, telegram crypto signals as well as accessibility market records can affect success. A lot of platforms supply demonstration profiles for technique. By utilizing platform tools efficiently, beginners may make informed selections in the unstable crypto market.

6. Technical review rudiments.

Technical analysis resources consist of fad lines, help as well as protection degrees, as well as indicators like relocating averages and also Relative Strength Index (RSI). Through studying past price movements, investors can easily determine styles and styles to forecast potential rate adjustments. Beginners in crypto time investing need to comprehend the basics of technical evaluation. Going through rate charts and also analyzing indications can easily provide understandings in to market disorders as well as possible access or even exit aspects.

Technical review rudiments.

Recognizing chart designs like triangulars and head and shoulders may aid investors determine options. In a similar way, knowing momentum clues like the Moving Average Convergence Divergence (MACD) can assist investors examine price motion stamina. Efficiency in technological analysis can boost a trader's decision-making and also boost their general exchanging strategy.

7. Key review basics.

Beginners in crypto day exchanging need to recognize the essentials of a piece or even token to make knowledgeable investing choices. Through studying whitepapers, roadmaps, and collaborations, traders may acquire understandings into a project's possible growth and also lasting stability. Staying up to date with news updates and also industry trends is actually likewise important to stay educated regarding elements impacting the cost motion of a cryptocurrency.

Vital evaluation basics.

Economic signs,

Crypto signals telegram market belief, requirements, and also worldwide celebrations may impact the cryptocurrency market. Beginners need to make use of vital evaluation alongside technical evaluation to have an extensive view of the marketplace.