If a large trade has already occurred and significantly shifted the price of a token, a back-running bot might place a trade after the price movement in anticipation of the market returning to equilibrium or continuing to trend. Back-Running

In back-running, a bot capitalizes on the aftermath of a significant market move.

Types of MEV Strategies

Front-Running: This occurs when a bot detects a large transaction and places its order first to profit from the resulting price movement. For instance, if a bot sees a large buy order for a token, it can buy the token first, sell it at a higher price, and pocket the difference.

While sniping bots can be a powerful tool, it's important to use them ethically and responsibly. Avoid engaging in activities that could harm the DeFi ecosystem, such as manipulating market prices or exploiting vulnerabilities in smart contracts.

For those who can master these tools, however, the future of DeFi trading looks bright. The ability to execute trades with speed, precision, and automation will continue to give savvy traders the edge they need in an increasingly competitive market.

This gives them a significant advantage in highly competitive markets.

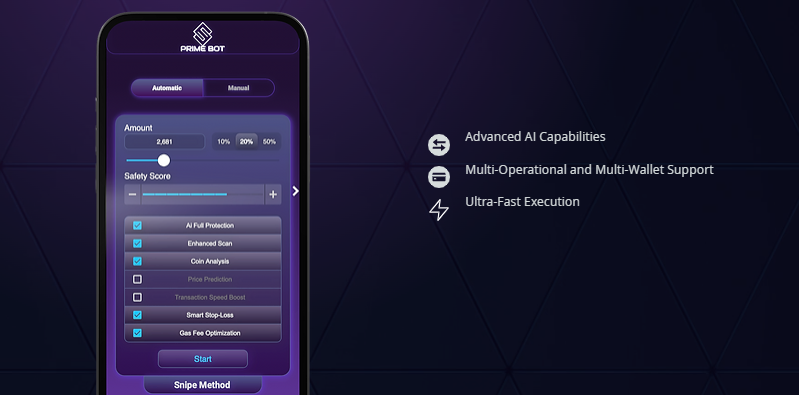

Accuracy: Bots can be programmed to follow precise trading strategies, reducing the risk of human error. Speed: Sniping bots can execute trades at speeds that are simply unattainable for human traders.

This is where sniping bots come into play. These automated tools are designed to execute trades at lightning-fast speeds, allowing users to capitalize on new token listings, liquidity additions, and other market events. In the fast-paced world of decentralized finance (DeFi), where opportunities can arise and disappear in a blink of an eye, the ability to act swiftly and decisively can be the difference between a substantial profit and a missed chance.

Gas War

Front-running bots can lead to what’s known as a "gas war," where bots compete with one another by bidding higher and higher gas fees to get their transactions processed first. This competition can drive up network fees, making it more expensive for all users to execute trades on the blockchain.

Instant Notification and Command Interface: Telegram’s chat-based interface allows users to interact with the bot through simple commands, enabling easy customization of trading strategies. Traders can set the bot to act the moment specific conditions are met, such as the availability of liquidity or price targets.

NFT Sniping Bots: These bots are used to automatically purchase non-fungible tokens (NFTs) at auction or from marketplaces. They can be particularly useful for securing rare or highly sought-after NFTs.

Benefits of Using a Sniping Bot

The cryptocurrency market has seen incredible growth over the past decade, with decentralized finance (DeFi) platforms becoming increasingly popular. While this growth has created opportunities for investors and traders, it has also led to the rise of

automated trading bot trading strategies like

front run bot-running bots, which take advantage of inefficiencies and high-speed execution to profit from other traders.

Increased Costs for Regular Traders

front run bot-running bots often force legitimate traders to pay more for tokens or lose out on favorable trades. As a result, sniping bots the original trader pays a higher price than anticipated, reducing their potential profit or leading to losses. When a bot front-runs a transaction, it drives up the price of a token before the original trade can be executed.

This incentivizes miners to prioritize their transactions, ensuring they can front-run or crypto sniping bot reddit sandwich other trades. Gas Optimization: To ensure their transaction is included in the block before others, MEV bots often bid higher gas fees.

This phenomenon has given rise to MEV bots, which are sophisticated tools used to exploit these opportunities and generate significant profits. In the world of decentralized finance (DeFi), where speed, automation, and transparency define the trading landscape, the concept of Miner Extractable Value (MEV) has become a hot topic. MEV refers to the additional profits that miners (or validators in proof-of-stake systems) can extract from blockchain transactions by prioritizing, reordering, or censoring transactions within a block.

They could then sell the tokens after the large buy order is executed, pocketing the profit from the price increase. For crypto sniper bot example, if a miner sees a large buy order for a token in the mempool (a pool of pending transactions), mev bot they might place their own buy order before the large trade is processed, driving up the price.

This is especially common in DeFi, where large buy or sell orders (often from whale investors) can drastically shift market prices. In decentralized trading, front-running refers to the practice of executing a trade in advance of a large transaction, anticipating that the big order will move the price in a favorable direction.

MEV Bots: Automating the Process

MEV bots are automated programs designed to detect and exploit these opportunities. By automating this process, MEV bots can operate at a speed far beyond human capability, giving their operators an advantage in capturing arbitrage or price discrepancies. These bots monitor the mempool in real-time and execute transactions that can capture MEV by

front run bot-running, back-running, or conducting sandwich attacks on other traders' transactions.