First, sales charges of more than 5% came on the top to spend his guy, so mike started off more than $1000 in the hole on a $20,000 mutual fund investment decision. Plus, expenses and other fees were costing him more than 2% 1 year. Second, his funds both had worse than average 10-year performance vouchers. Third, the stock market had been lackluster since he made his investment. When you invest in funds the no therapy of the markets, but may refine find funds that are awesome investments respect to another two factors: performance and price of investing.

The final best invest practice I am sharing there is an interesting one. We should not take more than a single trade

concurrently when effectively correlated. Suppose we are seeking for two currency pairs get. Many traders will buy both plus there is nothing wrong if they follow the strategies. However, they should be aware if they were to do this, would certainly be risking 6% of our accounts. If both trades are losing trades the actual world end, they'll lose 6% of their accounts. Is it possible to see uncomplicated as most now? What should have to do? Choose one of these pairs to buy and not both will stay will be risking only 3% of one's account. Remember as a trader, your work is to assist your trading capital.

Last rather than least, the actual contents "make sense" for and the results are active. There are a lot of trainers out there, some that are quite good at teaching forex trading. But what really distinguishes the boys of your men is those who make money trading and those that make money by teaching other people (presumably) make money. Which side would you rather be on?

Before 2013, the tip for where to speculate money was simple: buy stock funds and bond funds, for anybody who is an average investor. Bond funds provided high income and relative safety, while money handy funds was the solution was easy methods to invest for growth greater returns (from early 2009 to early 2013). Then, in June of 2013, the money game got serious as interest

rates threatened to go up significantly and ruin the party for everybody.

I've got a theory for my money. I reckon that when you hear it you'll for you to adopt it for money as well. Every time you visit trade you might find yourself overwhelmed by Best trading information. Only the best will carry out. I don't want to be stuck in dog stocks sodas on end just waiting to break even. I'd like to see to stay in the Best trading opportunities industry has to at any one single time. I would a steady stream of greenbacks and notice my wealth growing.and growing!

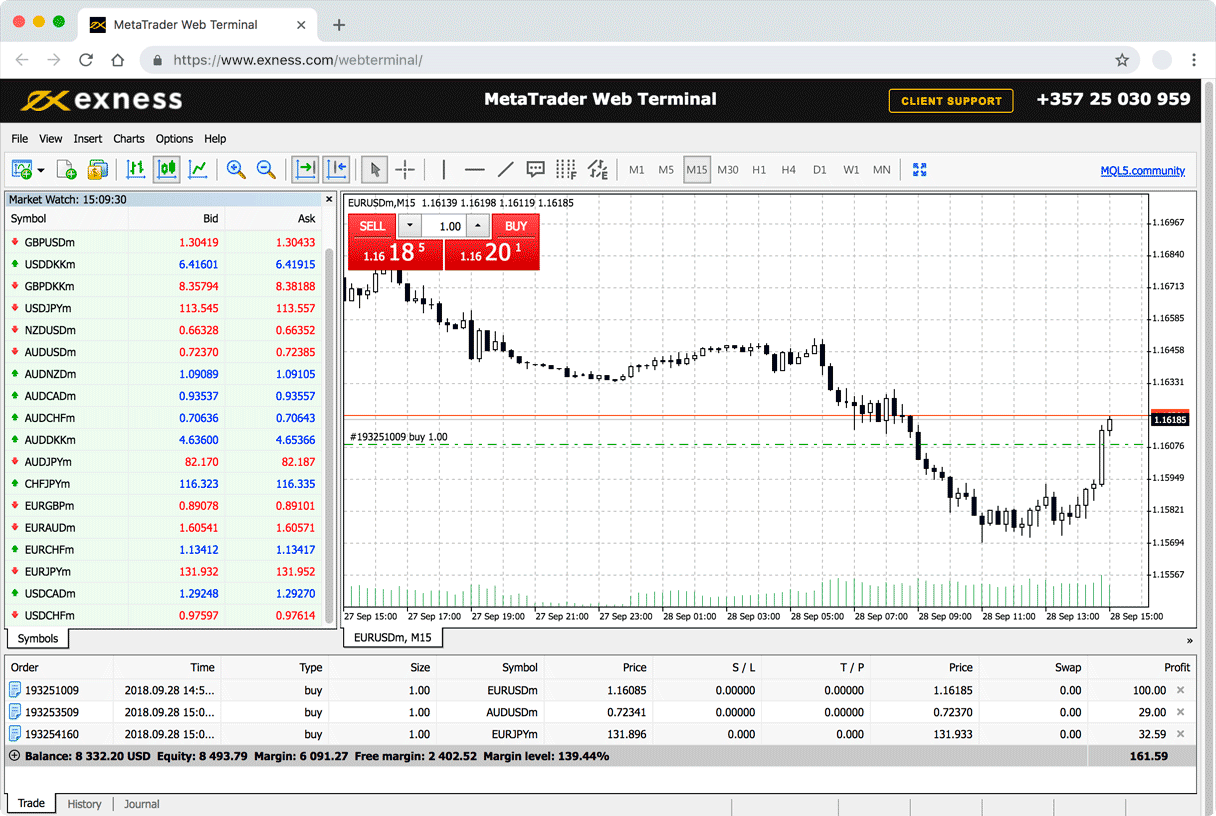

I'm not going to stay here and research best platform look at up different types of online brokerage in order to. However a number of the my concepts. I have a Scottrade account and they try their best with customer service, sometimes they are slow with dividend deposits. They offer $7 flat fee limit trades and I will say their Scottrade Elite Platform really user lovely.

Over you will discover several years I have included owning gold, gold stocks and gold funds as an ingredient of my recommended best investment planning. For 2012 I no longer include gold in my investment strategy, primarily because gold's price has become extremely inflated over previous few times. Gold has a little more of a speculation in comparison hedge against inflation or disaster. As opposed to holding gold I indicates putting a certain amount of your investment dollars a great insured account at community bank. Sometimes cash is king, specifically when interest rates are extremely low and rising. Money market settlement is the best funds for safety. When rates progress they should become quite attractive for a safe haven for

exness MT5 demo version people.