Future of ADAS and Insurance Premiums

As technology evolves, the relationship between ADAS and insurance premiums is likely to deepen. This section speculates on future trends and technologies that could further influence this dynamic.

How Insurance Companies Evaluate ADAS Insurance companies assess risk based on the likelihood and potential cost of claims. This section explains how insurers are beginning to factor in ADAS features as a variable in this assessment, potentially leading to adjusted premiums for equipped vehicles.

Integration with AI and Machine Learning

Combining radar data with artificial intelligence and machine learning algorithms will enable more sophisticated decision-making processes in

Portable Adas, enhancing predictive capabilities and vehicle autonomy.

Data Encryption and Anonymization: Techniques used to protect user data from unauthorized access.

User Consent and Data Sharing: Policies ensuring that drivers are aware of and agree to how their data is used and shared.

The Future of ADAS and Data Collection

ConclusionADAS represents a paradigm shift in automotive safety and insurance risk assessment. As the data from these systems becomes increasingly integral to the insurance industry, both insurers and drivers will need to adapt to the changes this technology brings to the insurance landscape.

Collision Avoidance Systems

Automatic Emergency Braking (AEB): AEB systems automatically engage the vehicle’s brakes when they detect an imminent collision, significantly reducing the chances of accidents.

Forward Collision Warning (FCW): This system warns drivers of an impending collision with a vehicle ahead, allowing them to take corrective action.

Lane Assistance Features

Lane Departure Warning (LDW): Alerts drivers when their vehicle begins to move out of its lane unintentionally.

**Lane Keeping Assist (L

KA):** Helps to steer the vehicle back into its lane if it begins to drift without signaling.

Improvements in Lens Technology

Aspherical Lenses and Nano-Coatings

Innovations in lens technology, such as the use of aspherical lenses and nano-coatings, have significantly reduced lens aberrations and improved light transmission, thereby enhancing image clarity and color accuracy.

Integration with Other ADAS Technologies

Radar often works in conjunction with other sensors, such as cameras and LiDAR, to create a comprehensive sensing environment. This synergy enhances the overall effectiveness and reliability of ADAS.

Future Trends in Camera-Based Sensor Technology

Quantum Image Sensors

Quantum image sensors, which promise significantly higher sensitivity and speed, are on the horizon, potentially revolutionizing low-light and high-speed photography.

Environmental and Durability Factors

The design and deployment of camera-based sensors must take into account environmental and durability factors to ensure reliable performance under varying conditions.

Adaptive Features

Adaptive Cruise Control (ACC): Automatically adjusts the vehicle’s speed to maintain a safe distance from the car ahead.

Adaptive Headlights: These headlights adjust their beam direction based on the vehicle’s speed and steering, improving nighttime visibility and safety.

Monitoring Systems

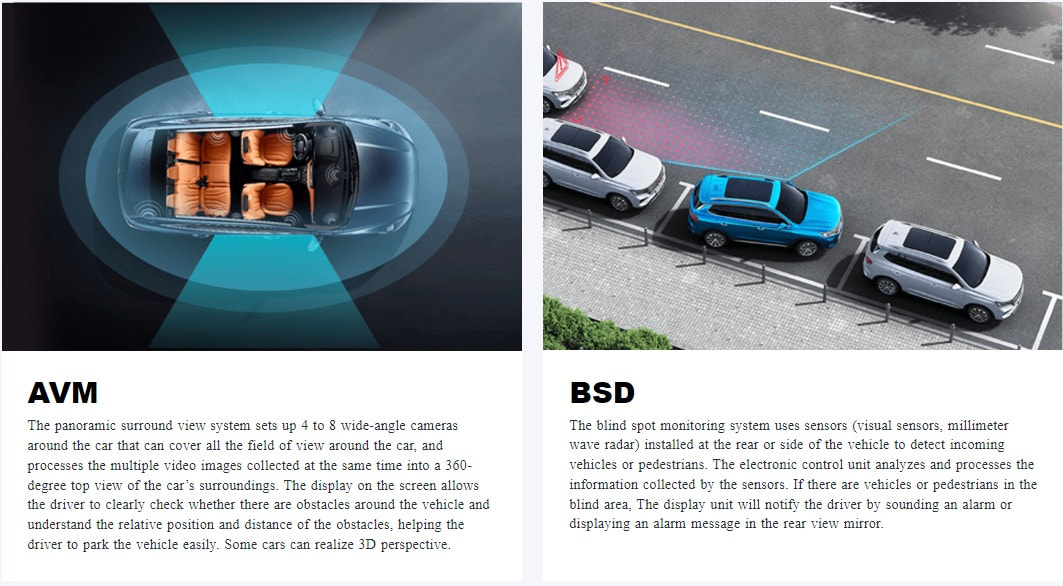

Blind Spot Detection (BSD): Alerts drivers to vehicles in their blind spot during lane changes.

Rear Cross Traffic Alert (RCTA): Warns drivers of approaching traffic from the sides when reversing out of parking spots.

Driver Alertness Monitoring

Drowsiness Alert Systems: Detect signs of driver fatigue and suggest taking breaks.

Attention Assist Technologies: Monitor driving patterns for signs of inattention or distraction.

Parking Assistance

Automated Parking Systems: Assist drivers in parking the vehicle, reducing the risk of parking-related accidents.

Rearview Camera and Parking Sensors: Provide visual and audio assistance to prevent collisions during parking.

Connected Car Features

Telematics and Real-time Data Analysis: Offer insights into driving habits, which can be used by insurers to tailor premiums.

Impact on Insurance Premiums: Features that improve safety can lead to lower premiums.

Safety and Security Enhancements

Anti-lock Braking Systems (ABS): Prevent wheels from locking up during braking, reducing the risk of skidding.

Electronic Stability Control (ESC): Improves a vehicle’s stability by detecting and reducing loss of traction.

The Integration of ADAS in Modern Cars

How ADAS is reshaping vehicle design: ADAS technologies are becoming standard in new vehicle models.

Consumer acceptance and usage trends: Increasing awareness and demand for ADAS features.

The Insurance Perspective on ADAS

How insurers evaluate ADAS features: Assessment of risk reduction potential and impact on claim frequency.

The balance between safety and risk: Weighing the benefits of accident prevention against the costs of ADAS repair.

The Cost-Benefit Analysis of ADAS for Insurers

Reduction in claims vs. cost of repairs: ADAS can lead to fewer claims but may increase repair costs due to their complexity.

Long-term financial impacts for insurers: Potential for overall cost savings and enhanced customer satisfaction.

Legal and Regulatory Aspects of ADAS

Compliance with safety regulations: Ensuring ADAS features meet safety standards.

Future legal implications for insurers: Navigating evolving regulations and liability issues.

Case Studies: ADAS and Insurance Claims

Analysis of real-world scenarios: Examining the impact of ADAS on specific insurance claims.

Impact on claims processing and outcomes: How ADAS features can lead to quicker claim resolution and lower costs.

Future Trends in ADAS and Insurance

Emerging technologies in ADAS: Anticipating the next wave of innovations.

Predictions for insurance industry adaptations: How insurers might evolve with advancing ADAS technologies.

FAQs on ADAS and InsuranceWhat are the most influential ADAS features for reducing insurance premiums?

How do insurers assess the effectiveness of ADAS in preventing accidents?

Can ADAS features lead to higher repair costs and how does this affect insurance?

What is the future of ADAS in automotive insurance?

Are there any legal considerations for insurers regarding ADAS-equipped vehicles?

How do ADAS features impact the overall safety rating of a vehicle?

ConclusionADAS features play a significant role in modern automotive safety and have become a key factor in the insurance industry. As these technologies continue to evolve, they offer potential for safer roads and more personalized insurance policies, benefiting both insurers and consumers.