Crypto bridges open up an assortment of possibilities for crypto users. Here stand several key benefits:

Increased Functionality: Bridges facilitate you to access an expanded spectrum involving DeFi (Decentralized Finance) applications and services developed on diverse blockchains. For instance, you may utilize the bridge to transmit your Bitcoin to the DeFi platform on the Ethereum blockchain to generate interest.

Enhanced Liquidity: By connecting blockchains, bridges establish a bigger pool in liquidity for crypto assets. This can result in narrower spreads (the discrepancy between the buying and selling price) and additional efficient trading.

Innovation: Bridges foster innovation by enabling developers to build applications that take advantage of all the strengths within different blockchains.

Security Dangers: Links, particularly centralized ones, may be vulnerable to breach attacks. Regularly investigate the link's protection measures ahead of employing it.

Fees: Bridging transactions often involve costs, which may vary according to the bridge and the chains involved.

Complexity: Understanding how connections work and choosing the correct one can be intricate for newcomers. It's essential to do your exploration ahead of making any shifts

Choose the Bridge: Research and select the reputable bridge that supports your blockchains you want to transfer assets between.

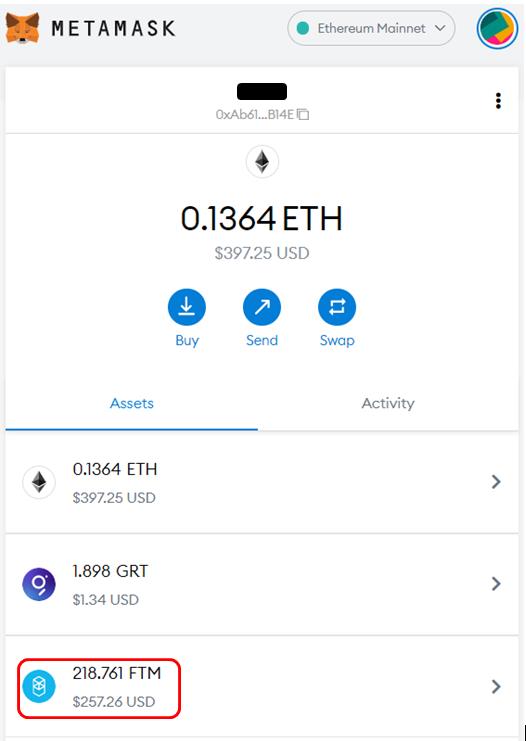

Connect Your Wallet: Connect your crypto wallet to a bridge interface.

Select Assets: Specify the amount and type for crypto asset you want

eth to heco bridge transfer.

Choose Destination Chain: Indicate which blockchain you want to send your assets to.

Initiate Transfer: Follow the bridge's instructions to initiate the transfer and pay any associated fees.

Think about a crypto bridge similar to a secure portal. When you need to shift your crypto assets, similar to Bitcoin or Ethereum tokens, away from one blockchain to another, the connection takes your original possession and locks it within a vault at the sending blockchain. It then creates a new, equivalent representation for that asset on the receiving blockchain. This new representation is often called a "sealed" token. Once the transaction is complete, the original locked asset is released.

Trusted (Centralized) Bridges: These bridges rely on the central authority to manage the locked assets. This may be faster and less expensive, but it introduces the single vulnerability, suggesting if this central authority is breached, your assets may be endangered.

Trustless (Decentralized) Bridges: These bridges employ smart contracts, self-executing code included inside the blockchain, to oversee the locking and releasing for assets. This gets rid of all need for the central authority, but it may be more intricate and costly.

Digital links play still one emerging innovation, but they serve one crucial part in the developing block-chain ecosystem. Considering the blockchain landscape carries on to develop and diversify, links will transform into even more critical for enabling smooth engagement and creativity. Developers stand continuously striving on improving connection protection, productivity, and user experience. With ongoing development, crypto links hold the potential to transform into the essential pathways for exploring the immense and interconnected planet of

blockchains.