These bots are programmed to "snipe" tokens by placing buy orders immediately after a token’s launch, often before the average trader can manually complete a transaction. What is a DeFi Sniper Bot?

A DeFi sniper bot is a type of trading bot specifically designed to execute trades the moment new tokens are listed on decentralized exchanges (DEXs) or when there’s a sudden price movement.

While sniping bots can be a powerful tool, it's important to use them ethically and responsibly. Avoid engaging in activities that could harm the DeFi ecosystem, such as manipulating market prices or exploiting vulnerabilities in smart contracts.

This automated trading tool is especially useful during Initial DEX Offerings (IDOs) or token listings, bsc sniping bot where tokens are launched on decentralized platforms like Uniswap,

pancakeswap sniping bot, or SushiSwap. Due to the nature of these events, token prices can fluctuate significantly in seconds, making sniper bots highly valuable for those looking to buy in at the lowest possible price or capture short-term price movements.

This may include strategies like front-running, back-running, or sandwich attacks. Since miners control which transactions are included in a block and in what order, they have the power to optimize the transaction sequence to their benefit. What is MEV?

Miner Extractable Value (MEV) is the value that can be captured by miners or validators by influencing the order in which transactions are processed in a block.

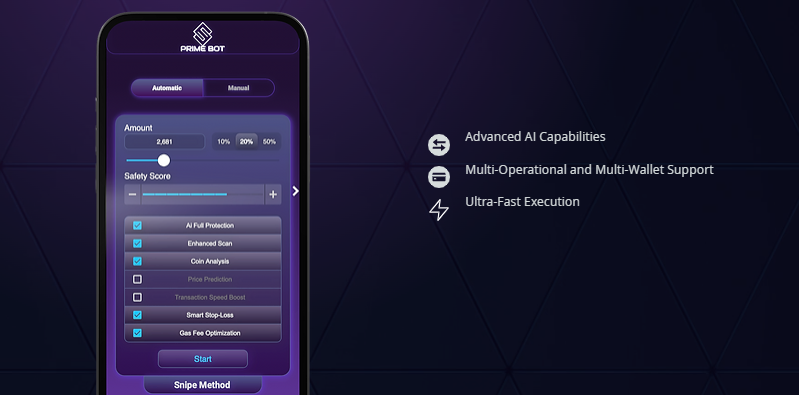

Pre-configured Instructions: The bot is pre-configured with specific instructions based on the trader's strategy. For example, it can be programmed to buy a set amount of tokens the moment a specific token’s liquidity pool becomes available or when its price reaches a certain threshold.

These bots are specifically designed to react quicker than human traders, executing trades based on preset strategies. In the fast-paced world of cryptocurrency, trading bots have become indispensable tools for both casual traders and institutional investors alike. A newer addition to this family of bots is the BSC Sniping Bot, which operates on the Binance Smart Chain (BSC), an increasingly popular blockchain for trading. Among the most popular trading bots are Sniper Bots,

front run bot-Run Bots, and Sandwich Bots—each offering distinct advantages in decentralized finance (DeFi).

Profit-Taking Mechanism: Many DeFi sniper bots are also programmed to automatically sell tokens once they’ve reached a certain profit margin. This feature helps traders lock in profits without constantly monitoring the market.

However, just because front-running isn’t explicitly illegal in many jurisdictions doesn’t mean it’s ethical. As the crypto market evolves, regulatory bodies may introduce rules to address these practices, especially as decentralized finance becomes more prominent.

front run bot-running bots exploit weaknesses in blockchain systems and harm regular traders by driving up prices or manipulating transactions.

Most DeFi platforms are built on public blockchains, such as Ethereum or Binance Smart Chain (BSC), where all transactions are visible before being confirmed in a block. How Does a DeFi Sniper Bot Work?

DeFi sniper bots rely on blockchain technology's transparency and real-time data.

Monitoring the Mempool: snipe bot telegram The bot continuously scans the mempool for large or potentially profitable transactions. The mempool holds unconfirmed transactions, and MEV bots use this transparency to identify trades that could impact the price of a token.

A sniping bot is essentially a piece of software that monitors the blockchain for specific events. This process is carried out so quickly that it can often outpace human traders, giving the bot a significant advantage. When a predefined condition is met (e.g., a new token is listed or a large amount of liquidity is added), the bot automatically places a buy order at a predetermined price.

Given the highly volatile nature of the cryptocurrency market, particularly with newly listed tokens, sniper crypto bot the ability to buy tokens within seconds of their launch can make a significant difference in profitability. Traders use these bots to "snipe" tokens—purchasing them immediately after they become available to capture gains before prices rise due to high demand.

These bots use high gas fees to prioritize their transactions, ensuring they get processed ahead of others. Automatic Execution: Once the bot detects the token’s listing, it places a buy order immediately, typically with pre-configured parameters set by the user (e.g., best crypto sniper bot the amount of tokens to buy, the maximum price willing to pay, gas fee settings).

This allows the bot to "

front run bot-run" the original transaction and profit from the subsequent price movement. Execute the Trade: The bot quickly submits a transaction to the network, using higher gas fees than the original transaction to ensure its order is processed first.

By understanding the different types of sniping bots and using them wisely, traders can increase their chances of success and maximize their profits. Sniping bots are a valuable tool for traders who want to stay ahead of the curve in the fast-paced world of DeFi. However, it's essential to approach this technology with caution and always prioritize ethical and responsible trading practices.