sniper bot

sniper bot Bots, Front-Run Bots, Sandwich Bots, and BSC Sniping Bots are leading the way in automated trading, helping traders execute strategies that would be impossible to carry out manually. While these bots offer incredible opportunities for profit, it’s important for users to understand the risks involved, such as market volatility and the potential for nft sniping bot bot errors. As decentralized finance evolves, so too do the tools that traders use to gain an edge in the market.

Instant Notification and Command Interface: Telegram’s chat-based interface allows users to interact with the bot through simple commands, enabling easy customization of trading strategies. Traders can set the bot to act the moment specific conditions are met, such as the availability of liquidity or price targets.

Key Steps of a Front-Running Bot:

Monitor the Mempool: The bot continuously scans the mempool for large or profitable transactions that are about to be executed on a DEX. These might include large trades that could shift the price of a token.

The ability to execute trades with speed, precision, and automation will continue to give savvy traders the edge they need in an increasingly competitive market. For those who can master these tools, however, the future of DeFi trading looks bright.

By automating this process, MEV bots can operate at a speed far beyond human capability, giving their operators an advantage in capturing arbitrage or price discrepancies. MEV Bots: Automating the Process

MEV bots are automated programs designed to detect and exploit these opportunities. These bots monitor the mempool in real-time and execute transactions that can capture MEV by front-running, defi

sniper bot crypto bot back-running, or conducting sandwich attacks on other traders' transactions.

Monitoring the Mempool: The bot continuously scans the mempool for large or potentially profitable transactions. The mempool holds unconfirmed transactions, and MEV bots use this transparency to identify trades that could impact the price of a token.

Traders use these bots to "snipe" tokens—purchasing them immediately after they become available to capture gains before prices rise due to high demand. Given the highly volatile nature of the cryptocurrency market, particularly with newly listed tokens, the ability to buy tokens within seconds of their launch can make a significant difference in profitability.

One such tool that has gained popularity is the snipe bot, particularly in Telegram, a platform known for its use by crypto communities. As the cryptocurrency market grows increasingly competitive and fast-paced, traders are constantly seeking tools to gain an edge in executing timely and profitable trades. A Telegram snipe bot is an automated tool designed to help traders execute trades with precision and speed, often during critical moments such as token launches or significant market events.

Analyzing Profitable Opportunities: The bot uses algorithms to determine which transactions can be exploited for MEV. For example, if it detects a large buy order that is likely to drive up a token's price, it might place its own buy order ahead of the original transaction (front-running) and then sell the tokens for pancakeswap sniping bot a quick profit.

These bots are programmed to execute trades the moment a token is listed on decentralized exchanges (DEXs) such as Uniswap or PancakeSwap, allowing traders to get in on the action faster than they could manually. What is a Telegram Snipe Bot?

A Telegram snipe bot is an automated trading

sniper bot crypto that operates through the Telegram platform, typically through specific bot commands or integrations with Telegram groups dedicated to cryptocurrency trading.

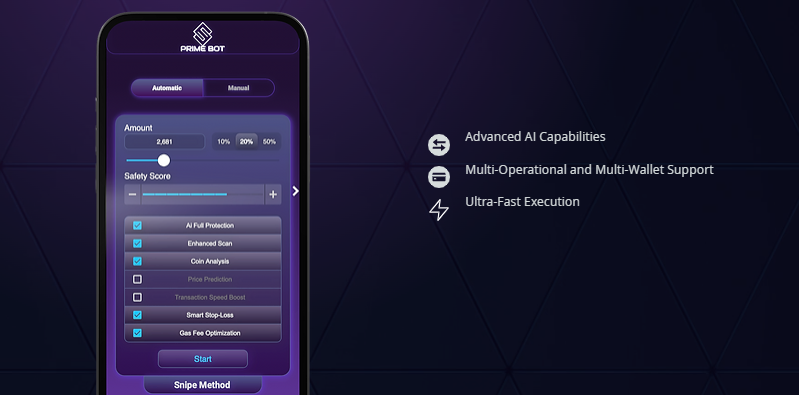

Pre-configured Instructions: The bot is pre-configured with specific instructions based on the trader's strategy. For example, it can be programmed to buy a set amount of tokens the moment a specific token’s liquidity pool becomes available or when its price reaches a certain threshold.

Due to the nature of these events, token prices can fluctuate significantly in seconds, making

sniper bot crypto bots highly valuable for nft sniping bot those looking to buy in at the lowest possible price or capture short-term price movements. This automated trading tool is especially useful during Initial DEX Offerings (IDOs) or token listings, where tokens are launched on decentralized platforms like Uniswap, PancakeSwap, or SushiSwap.

sniper bot crypto bots are designed to target newly launched tokens on decentralized exchanges (DEXs) like Uniswap, PancakeSwap, or SushiSwap. However, manually executing these trades is nearly impossible due to the speed of price changes and network congestion. For those who can act quickly, there is an opportunity to buy the token at a very low price and sell it later as the price rises. When a new token is listed on a DEX, its price is often extremely volatile.

Monitoring the Mempool: The bot continuously monitors the mempool (the temporary space where pending transactions are stored before being confirmed) for upcoming token listings or large trades. This allows the bot to detect when a new token is about to go live or when a significant trade is about to be executed.