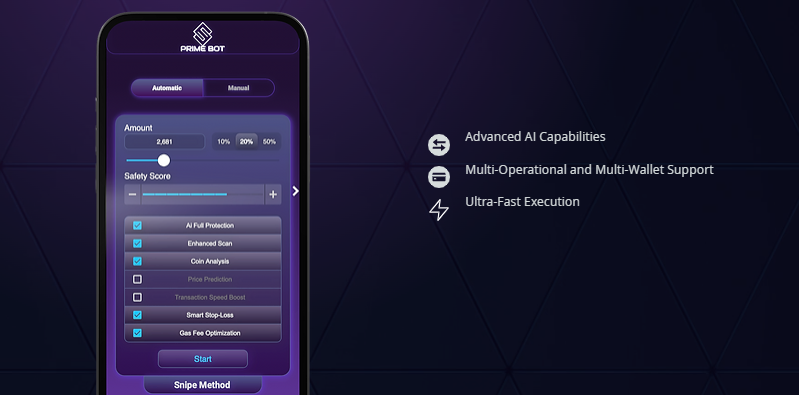

These automated tools are designed to execute trades at lightning-fast speeds, allowing users to capitalize on new token listings,

liquidity bot solana additions, solana liquidity bot and other market events. This is where sniping bots come into play. In the fast-paced world of decentralized finance (DeFi), where opportunities can arise and disappear in a blink of an eye, the ability to act swiftly and decisively can be the difference between a substantial profit and a missed chance.

Positioning: They place trades in optimal positions, ahead of large market moves.

Profit Potential: By getting in before big price swings, these bots can lock in profits that would be difficult to achieve manually.

What Are Sandwich Bots?

Most DeFi platforms are built on public blockchains, such as Ethereum or Binance Smart Chain (BSC), where all transactions are visible before being confirmed in a block. How Does a DeFi Sniper Bot Work?

DeFi sniper bots rely on blockchain technology's transparency and real-time data.

This feature helps traders lock in profits without constantly monitoring the market. Profit-Taking Mechanism: Many DeFi sniper bots are also programmed to automatically sell tokens once they’ve reached a certain profit margin.

These bots use high gas fees to prioritize their transactions, ensuring they get processed ahead of others. Automatic Execution: Once the bot detects the token’s listing, it places a buy order immediately, typically with pre-configured parameters set by the user (e.g.,

front run bot the amount of tokens to buy, the maximum price willing to pay, gas fee settings).

What is a DeFi Sniper Bot?

A DeFi sniper bot is a type of trading bot specifically designed to execute trades the moment new tokens are listed on decentralized exchanges (DEXs) or when there’s a sudden price movement. These bots are programmed to "snipe" tokens by placing buy orders immediately after a token’s launch, often before the average trader can manually complete a transaction.

However, just because front-running isn’t explicitly illegal in many jurisdictions doesn’t mean it’s ethical. As the crypto market evolves, regulatory bodies may introduce rules to address these practices, especially as decentralized finance becomes more prominent.

front run bot-running bots exploit weaknesses in blockchain systems and harm regular traders by driving up prices or manipulating transactions.

Traders can set the bot to act the moment specific conditions are met, such as the availability of liquidity or price targets. Instant Notification and Command Interface: Telegram’s chat-based interface allows users to interact with the bot through simple commands, enabling easy customization of trading strategies.

While these bots can profit from the transparency of blockchain transactions, crypto bot pancakeswap they also create unfair advantages and can harm regular users by increasing costs and manipulating markets. By understanding how

front run bot-running bots operate and adopting strategies like using limit orders, increasing transaction privacy, and exploring Layer 2 solutions, traders can protect themselves and improve their chances of successful trading.

front run bot-running bots in crypto are a growing concern for traders on decentralized exchanges.

NFT Sniping Bots: These bots are used to automatically purchase non-fungible tokens (NFTs) at auction or from marketplaces. They can be particularly useful for securing rare or highly sought-after NFTs.

Benefits of Using a Sniping Bot

However, with this shift has come a surge in advanced trading technologies, such as DeFi sniper bots, which are becoming increasingly popular among traders looking for a competitive edge. Decentralized Finance (DeFi) has revolutionized the world of cryptocurrency trading by offering decentralized, permissionless platforms where users can trade without intermediaries.

For example, a frontrun bot might detect a large sell order and place a buy order just before it, potentially buying the token at a lower price. When a significant amount of liquidity is added, the bot can quickly buy the token at a discounted price.

Frontrun Sniping Bots: These bots attempt to predict the actions of other traders and place their orders ahead of them. PancakeSwap Sniping Bots: These bots are specifically designed to target new token listings on PancakeSwap, one of the most popular decentralized exchanges on the Binance Smart Chain (BSC).

Liquidity Sniping Bots: These bots focus on capitalizing on liquidity additions to existing tokens.

Avoid engaging in activities that could harm the DeFi ecosystem, such as manipulating market prices or exploiting vulnerabilities in smart contracts. While sniping bots can be a powerful tool, it's important to use them ethically and sniping bots responsibly.

Speed: Sniping bots can execute trades at speeds that are simply unattainable for human traders. This gives them a significant advantage in highly competitive markets.

Accuracy: Bots can be programmed to follow precise trading strategies, reducing the risk of human error.